Welcome to LTC Key, the #1 site for comparing Long Term Care (LTC) Insurance policies online. Our areas of expertise include Long Term Care Insurance quotes, reviews, rates, ratings, and comparisons of LTC insurance services providers – focusing exclusively on blue-chip carriers. We also actively pursue and deliver cost-related information that can help our national audience choose wisely and save BIG on long term care insurance.

We like our clients to understand that LTC insurance is just like any other form of insurance in the sense that you may purchase it but never use it. To ensure that you’re neither overinsured nor underinsured, our agents’ help you arrive at a reasonable balance between too much and too little coverage.

Long Term Care Insurance

Contrary to common misconceptions, Long Term Care Insurance happens to be much more than simply retirement planning. It helps safeguard your nest egg from the uncertain possibility you’ll need care at some point or the other. LTC Coverage also guarantees your peace of mind in knowing you’ll receive quality care if at all you ever need it. It essentially gives you a shelter from which you can confidently plan for a happy retirement.

- According to Harvard Magazine, the average life expectancy is 81.4 years for women and 76.8 years for men. Advancements in health sciences are increasing chances that people will live even longer. Check out some more statistics on Long-Term Care here.

- The New England Journal of Medicine also reports that more than half of all people over the age of 65 will end up needing LTC services.

- Similarly, The Wall Street Journal proclaims that an astounding 55% of all seniors who are 85 years or older suffer from Alzheimer’s or another form of dementia. All these people need some form of assistance. Due to this alarming trend, and given the devastating costs of Long Term Care, more and more young people are purchasing LTC coverage to protect their inheritance.

Longevity is Increasing Needs

Widespread Innovation and subsequent upgrades in available healthcare technology means that the average American citizen can now live longer. This increased longevity is directly expanding the possibility that many of us will need LTC services at a point in our life. A significant percentage of elderly U.S. citizens suffer from Alzheimer’s, and other degenerative ailments such as diabetes, obesity, heart problems, cancer, stroke, Parkinson’s disease, and accident-related injuries. These almost always necessitate Long Term Care, for which LTC insurance pays.

What Does LTC Pay For?

Long Term Care insurance coverage pays for care services provided at home, in a nursing home, adult day care or assisted care facilities. Statistics suggest that 72% of LTC claims are to pay for in-home health care. This is where aides come to your home and provide help with ADLs (Activities of Daily Living) such as eating, dressing, bathing, and cleaning. Long Term Care coverage gives you the guarantee that you can continue staying at your own residence while receiving care.

Here’s a problem – the cost of long-term care could empty your entire life’s savings

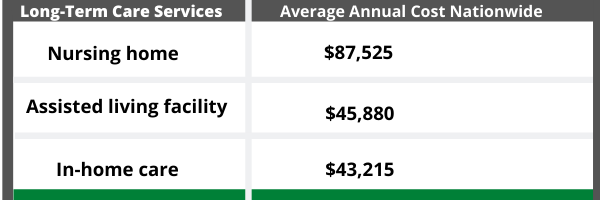

What’s the average annual cost of long-term care today?

The solution – planning ahead with LTC insurance

Buy a good long-term care protection package and plan ahead.

The fact of the matter is that long term care costs can deplete your nest egg, draining away the savings that you worked so hard for. For individuals who get admitted to a nursing home, the average duration of stay is 3.3 years. At $87,525 per year, that means you have to part with $288,833 for a single individual and $577,665 for a couple. Factoring in inflation, this cost could more than triple after the next 30 years or so. That’s why you advise our clients to always settle on policies that have protection from inflation. It makes sure that over time, the money they contribute to the LTC policy doesn’t lose purchasing power.

Long Term Care is a greater financial risk compared to home, fire and auto accidents. By getting coverage, you’re essentially safeguarding your retirement future. You can rest assured that your nest egg is safe and that none of your children will have to help with the burden of footing long-term care bills.

LTC Key provides steadfast assistance so that you can choose the best available Long Term Care insurance policy right from your home. We eliminate bottlenecks in the process of shopping for LTC cover and change the rules so that the top carriers compete for your business (not the other way round).

Get your Quote Now

LTC Key helps you plan how you can:-

- Maintain your independence – if the need arises, you can receive Long Term Care within the comfort and familiarity of your own home.

- Protect your Nest Egg (401K, IRA’s, Stocks, CD’s, etc) – by planning ahead, you can rest assured that your savings and investments won’t be depleted. You also reduce the risk that you’ll lose your home or receive substandard care services at a Medicaid nursing home.

- Avoid burdening your family – by buying long-term care coverage, you eliminate the possibility that your children or immediate family will have to pay for your care.